hey hey what's up my friends so in

training right i'll share with you a

specific trading strategy right that has

a 88.89

winning rate i'll give you the exact

trading rules uh the performance matrix

of this strategy

examples of it and much more so with

that said

let's get started so first and foremost

what is this

trading strategy about and why it works

say that uh larry connors right he is

the person that i learned from so

credits to larry corners because without

him right

today's trading won't even be available

for you to watch because the idea the

concept the strategy

i learned it from him okay so the the

core idea right behind this

trading strategy is that it's a pullback

stock trading strategy

and here's the thing right why why is

that right because in the long run you

know that the market is the stock market

it's in a long-term uptrend

why the reason is simple because the

stock market tracks

what the economy is doing the reason why

the u.s stock market has been in a

long-term uptrend since 1900s is because

the economy in the u.s in 1900s compared

to today

has improved so much right over the last

100 years or so

same thing for the singapore stock

markets same thing for the china stock

markets right most stock markets out

there they are in a long term uptrend

because

today's economy is much better than

where we were where we were like

50 years ago 100 years ago okay but

here's the thing just because a

market is in a long term uptrend doesn't

mean that

it goes up in one straight line that

doesn't that is how it works right

because as you know

a market could be in an uptrend but it

has a series of you know higher highs

and higher lows and in the short run

right because of panic selling because

of profit taking because of fear in the

market right

the prices right in the market could go

below its true valuation

okay so this means right that there

exists right

profitable trading opportunities right

for traders like us to take advantage of

and this is what

uh today's trading strategy is all about

we are looking to identify pullback in

the stock markets

we are looking to identify fear in the

markets we are looking for the market to

you know uh

uh to have a sell-off right then we

enter on the pullback and hopefully we

are able to profit right when the market

makes the next swing up higher

so these are the rules right of this

trading strategy we are trading on the s

p 500

market you can do it on the etf you can

do it on the futures it's up to you

uh even if you want to you can test it

on your own local stock markets

you can test it on the russell 1000 you

can test it on nasdaq i'll leave it to

you

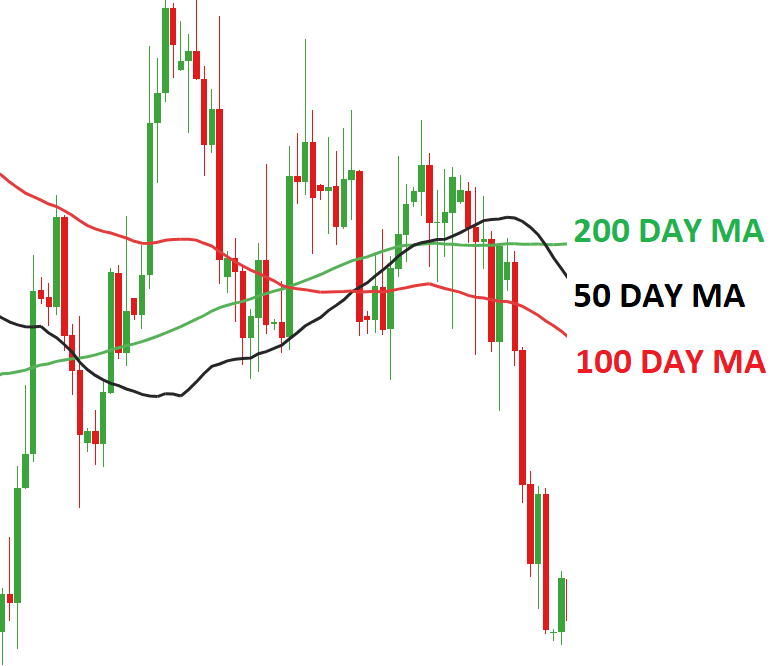

okay again first and foremost we want to

be trading right when the overall market

is in an uptrend so

our way to define the trend is that the

s p 500

must be above the 200-day moving average

so you just pull out your 200-day moving

average if the s p 500 is above it

great now we have permission right to to

trade right if not

we will remain in cash our entry

this is very straightforward right now

entry is also otherwise known as the uh

defining the depth of the pullback we

want the 10 period

rsi to be below 30. okay so this is

how we define our so-called trading

setup right our entry point the 10

period

rsi must be below 30. once it's below 30

what we're going to do

is that when the market opens the next

day we'll just simply enter

using a market order right whatever

price it is we'll enter on market order

our exit very straightforward as well we

are looking to exit right when the 10

period rsi

has crossed above 40 or after 10 trading

days right because sometimes

the 10 period rsi can be re below 40 for

quite a number of

days or weeks especially during

recession so this is where we have a

time stop right

after 10 trading days uh the market or

rather the 10 period rsi has not crossed

above 40

will also manually exit the trade okay

but if the 10 period rsi has crossed

above 40 then we will simply sell it

on the next days open make sense

so let's have a look at a few examples

shall we

so if you look at this chart what i've

shared with you over here is just simply

the chart of the s p 500 this is the

futures market chart

so let's have a look at how this trading

setup looks like

so you can see this black line over here

we have is the uh

200-day moving average this black line

here so the smb 500 is above it

that's uh that's the first criteria

second criteria

we need is for the 10 period rsi to go

below

30. so i've pulled out the 10 period rsi

so you can reference it easily over here

10 period rsi

and you can see over here right now the

rsi value is 19.

so this has met our criteria because if

you recall

the 10 period rsi must be below

30. so when the market closes today

right rsi now is trading at 19. so our

entry

i mean our setup is met we are going to

enter on the next day's open

so when the market open the next day

okay we will

simply go long over here okay so what's

the exit criteria it is when the 10

period rsi

crosses above 40 or after 10 trading

days

so you can see on the next day rsi has

now crossed above

40. over here okay not not exactly the

next day but

two days later rsi has crossed above 40

close at 48. so we'll exit

on the next day open which is on this

candle here we exit

on this candle open so you can imagine

right for this setup your entry point is

here you buy here

and you sell here just capturing this

kind of like this one swing up higher

this one swing

okay let's have a look at another

trading setup

so this time around again the rules are

the same right looking to buy when rsi

is below

30. so we have it over here again look

at this

at this point on today smp is still

above the 200-day moving average so the

overall trend is still towards the

upside

look at the rsi now the value is 28. so

we have the uh the the setup right is

made right because the 10 period rsi is

below 30.

so what we'll do is we enter on the next

day open so next day market open here

so we go along on the next day open our

exit is after 10

trading days or when the 10 period rsi

has crossed above

40. so in this case

here it has now crossed above 40 so we

exit

on the next day open which is somewhere

here

so we can see we enter here exit here so

thereby just capturing this uh

this uh again this small swing up higher

so this is pretty much how this

trading strategy works right and again i

know this is

just some simple chart examples but so

let me share with you the the matrix

right

of how this uh trading strategy has

performed so many of you have asked me

right what platform i used to do the

back testing so this one is uh

this platform is called army broker

right you can see that these are the

results right from 1996 right all the

way to

2019 which is the duration of the back

test from 1996 to 2019 about 14 years of

data

these are the result right of every

trade right that the

trading strategy has taken so you can

look at the

numbers which you can digest easily okay

this is the excel spreadsheet table that

i've exported

you can see that over the 14 years we

have about 36 trades

our winning rate over here is 88.89 as i

mentioned earlier and uh

the average gain right per trade right

average

profit per trade is about 1.43

and your average loss right on each

trade is about negative

0.87 percent so overall right this is a

uh it seems like you know something that

will give you an edge in the markets

okay

however there is a downside to this and

i'll explain this shortly

so moving on right how can you apply

this to your trading right so first

lesson is this right you want to look

for buying

opportunities right after a strong

quebec in the stock market so when you

see

the stock market makes a strong pullback

right the

top process that you have right

especially if it's still above the

200-day moving average is that

where can i look for buying

opportunities maybe a pullback towards

uh like for example the time period rsi

is below 30

if you're a discretionary trader you can

use tools like you know candlestick

patterns

uh support trendline right to help you

better time your entry right that's one

way you can go about doing it

and one thing to point out is that you

want to avoid shorting the stock market

especially you know i know it's tempting

no

well strong bearish momentum in the

stock markets right you know it's time

to sell something to shut the market

market is going to collapse

but here's the thing right based on

historical testing right more often than

not

the price right tends to reverse back up

higher so as much as possible right you

want to avoid shorting

the stock markets especially right if

it's still above the 200-day moving

average

makes sense and the second thing is this

right so as mentioned earlier i

i said that you know the so-called

downside to this trading system is that

there are

not many trading opportunities right so

as you've seen over the last 14 years we

have about 36

trading opportunities on the smb 500 so

what you can do right to have more

trading opportunities is to

for example you can trade uh more etf

like for example you can trade the s p

500 the russell 1000

russell 3000 nasdaq right all this

together to get more trading

opportunities

or you can also you know trade

individual stocks right individual

stocks in let's say the s p 500

this will give you more trading

opportunities right to exploit

this uh this is called inefficiency or

pattern

in the stock market and if you want to

learn more about how you can actually

apply this concept to trade individual

stocks in the market then i recommend

Good page

ReplyDeleteAmazing

DeletePlease,show me how to earn

ReplyDeleteOk

DeleteGood page��

ReplyDeleteGood page😉

ReplyDeleteGood page

ReplyDeleteSure

ReplyDeleteup

ReplyDeleteSure sir

ReplyDeleteBonne initiative

ReplyDeleteThis is so lovely

ReplyDeleteLove you FF

ReplyDeleteThat's nice how can i make

ReplyDeleteChat me up on WhatsApp +2349048351609

DeleteComment ça se passe ici

ReplyDeleteOops

ReplyDelete